Alătură-te comunității noastre!

Vezi cele mai recente știri & informații din piața de capital

Beijing is discussing for over a decade with American regulators the logistics of allowing onsite investigations of audits made to Chinese companies listed in New York.

On Thursday that has been granted, with the Public Company Accounting Oversight Board gaining complete access to inspect those firms for the first time in history.

The PCAOB has now “unprecedented” access to double-check the onshore audits of New York-listed Chinese firms.

The regulator warned that the breakthrough “should not be misconstrued in any way as a clean bill of health” for Alibaba and its compatriots.

In December 2020, the U.S. legislature passed the Holding Foreign Companies Accountable Act.

The Congress’ document is establishing a 2024 deadline for the U.S. and China to reach an agreement before issuing a trading ban for companies using audit firms that refuse PCAOB inspections for three consecutive years.

Many investors assumed 2023 would result in a purge of Chinese tickers, so the Thursday agreement is a welcoming sign of defrosting between the two world powers.

According to Reuters, state-owned giants including oil refiner Sinopec voluntarily decamped while its peer CNOOC was booted off on a separate government order.

Their departure helped erase over half a trillion dollars from the collective value of Chinese companies there between June and September.

Beijing had the choice of still refusing to make concessions to U.S. regulators, but that would have been out of pure nationalism.

Especially after financial frauds at companies like Longtop Financial and Luckin Coffee destroyed billions of dollars of shareholder value with no recourse.

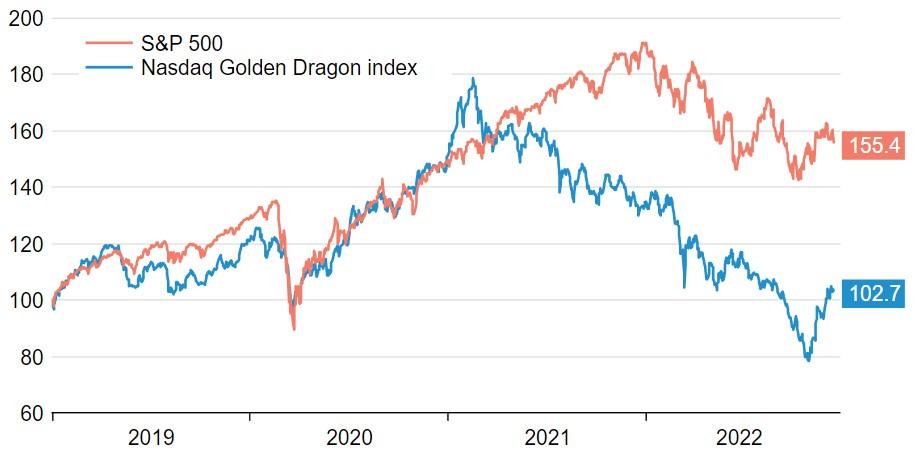

New York listed chinese stocks are recovering as US watchdogs gain access. Source Refinitiv Datastream 15.12.2022. Rebased, 100 = Dec 31, 2018, K Hamlin, Breakingviews

Also, China needs access to New York capital, particularly when local markets are soft.

Several large Chinese stocks that had been under the threat of delisting jumped at the stock market open in New York, although the gains did not last amid a broad market sell-off.

The Invesco Golden Dragon index fund of Chinese stocks closed down 2.1%, slightly outperforming the broader Nasdaq Composite index, which lost 3.2%.

The Golden Dragon index is up 50% from a nadir in late October, so Beijing cannot complain over the bargain.

Vezi cele mai recente știri & informații din piața de capital