Alătură-te comunității noastre!

Vezi cele mai recente știri & informații din piața de capital

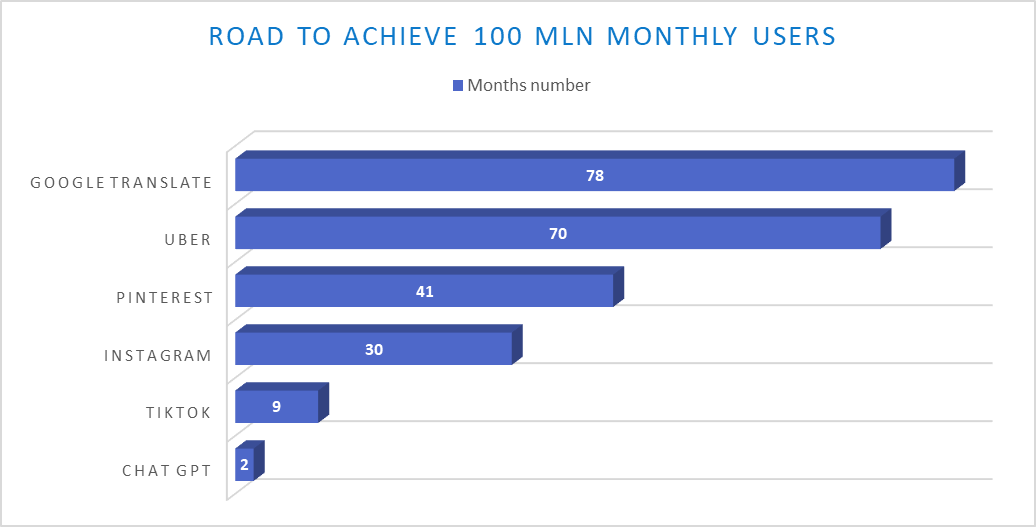

Artificial intelligence has long influenced the human imagination. While we are still a long way from creating so-called general artificial intelligence (AGI), its development is accelerating strongly, driven by falling costs (machine learning) and increasing capabilities, as we have witnessed with the creation of the recently popular ChatGPT, which according to Reuters is the fastest-growing application in history.

Is this a new long-standing investment trend in the markets? Or just a temporary momentum as was the case with several threads related to blockchain, green energy or the metaverse?

ChatGPT took just 2 months to attract 100 million monthly users, beating TikTok. It’s a new record. Source: XTB Research

The race for growth

The year 2023 brought a new wave of interest in AI, fueled by falling inflation, among other factors. Investor sentiment improved, and with the relief came an increased appetite for risk and demand for technology companies, heavily oversold in 2022.

The catalyst for the euphoria was an AI chatbot, ChatGPT, built by OpenAI in partnership with Microsoft (MSFT.US), which is investing heavily in the company starting in 2019.

With $10 billion in funding, the giant intends to saturate its own Bing browser with artificial intelligence, potentially increasing its market share in particular compared to Alphabet (GOOGL.US).

Investors have become convinced that things are ‘getting serious’ around AI since Microsoft, surrounded by a wave of layoffs and cost-cutting, intends to spend a fortune on its development.

Google and China’s Baidu (BIDU.US) quickly joined the ranks of investors. The CEO of chipmaker Nvidia compared the launch of Chat GPT to the debut of the iPhone.

Further development of the chatbot could see it start programming in popular languages like Python and spread access to AI tools in a powerful way affecting productivity and the job market.

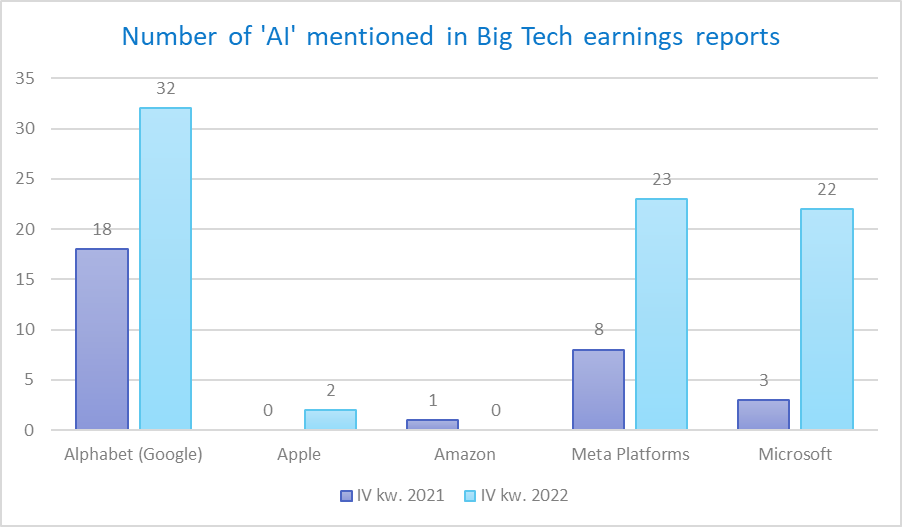

The number of AI mentions in the latest quarterly report for Meta Platforms rose 188% y/y, Google by 78% y/y. The record growth belongs to Microsoft, it was 633% y/y. Source: XTB Research, Ark Invest

Google or Microsoft ?

The interest in AI from Microsoft, Alphabet and Meta Platforms (META.US) is obvious, and has to do with improving browsers, monetizing user data, building software faster and more efficiently, and developing the Metaverse, which is ultimately intended to become a ‘hub’ for artificial intelligence in addition to VR/AR technologies.

Investors have begun to see a thread of rivalry between the Silicon Valley giants. Google’s stock price after the failed launch of Bard AI, a competitor to ChatGPTI ‘flopped’ more than after the presentation of weak quarterly results as investors began to see a threat to Google’s browser dominance.

Although Microsoft has set the bar high, due to the network effect, the Bing browser may find it extremely difficult to dethrone Google, which holds more than 80% of the search engine market share. However, under the principle of ‘he who does not move forward, moves backward’, more and more companies are likely to take up the challenge and explore the business possibilities of AI.

Generative artificial intelligence expertly answers questions using huge databases, and can also create images and videos. It’s worth remembering that AI isn’t just about content – it’s also about optimizing companies’ costs, analyzing data and models, or making employees more efficient.

Potential winners

Given the growing demand for available computing power, AI presents an opportunity to increase demand for chips from the most powerful semiconductor manufacturers like Nvidia (NVDA.US), AMD (AMD.US) and Taiwan Semiconductor (TSM.US).

Chinese companies, which can potentially monetize AI more easily thanks to widespread access to the sensitive data of China’s hundreds of billions of internet users, may also prove to be a black horse. Baidu emerges as the leader here, but Alibaba (BABA.US) or JD.com (JD.US) could also benefit.

The largest companies may be reluctant to look at extremely risky strategies, preferring diversification and limiting exposure to their chosen technology sector, making potential beneficiaries of the AI trend companies that today focus exclusively on developing artificial intelligence like C3.ai (AI.US).

This company’s products have been described by analysts D.A. Davidson as ‘scarce’ and comparable to the debuting Windows. The company has its own generative intelligence software and contracts with the US Air Force and companies like Shell, Baker Hughes and Koch Industries.

Also of interest, especially in the metaverse, may be the stock of SoundHound (SOUN.US) a company engaged in voice processing based on AI tools.

The problem, however, seems to be the profitability and financial health of companies operating solely in the new technology industry, including AI.

In an environment of aggressive central bank policies, which means rising debt service costs with limited availability of external financing for a long time to come, we may see the dominance of speculative price fluctuations.

On the other hand, however, we see that despite all the difficulties, AI has not discouraged investors. There are many indications that the AI trend will last although it will certainly face ups and downs, and it is still too early to determine the winners.

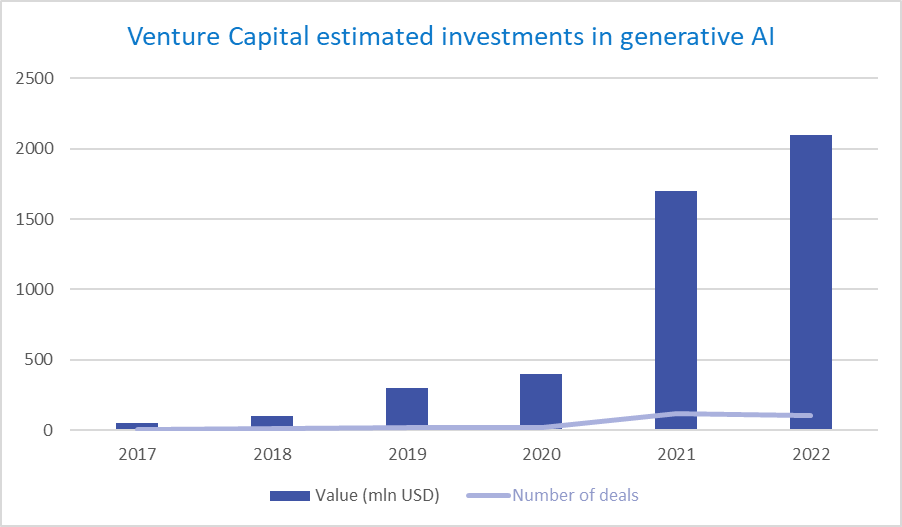

VC funds have not backed away from funding generative AI initiatives despite difficult macro enviroment. In 2022, the number of deals fell by only about 10%, but the total dollar value rose from $1.7 billion to more than $2 billion. In comparison, VC funding for cryptocurrencies entities fell by about 91% in 2022. Source: XTB Research, PitchBook, FT

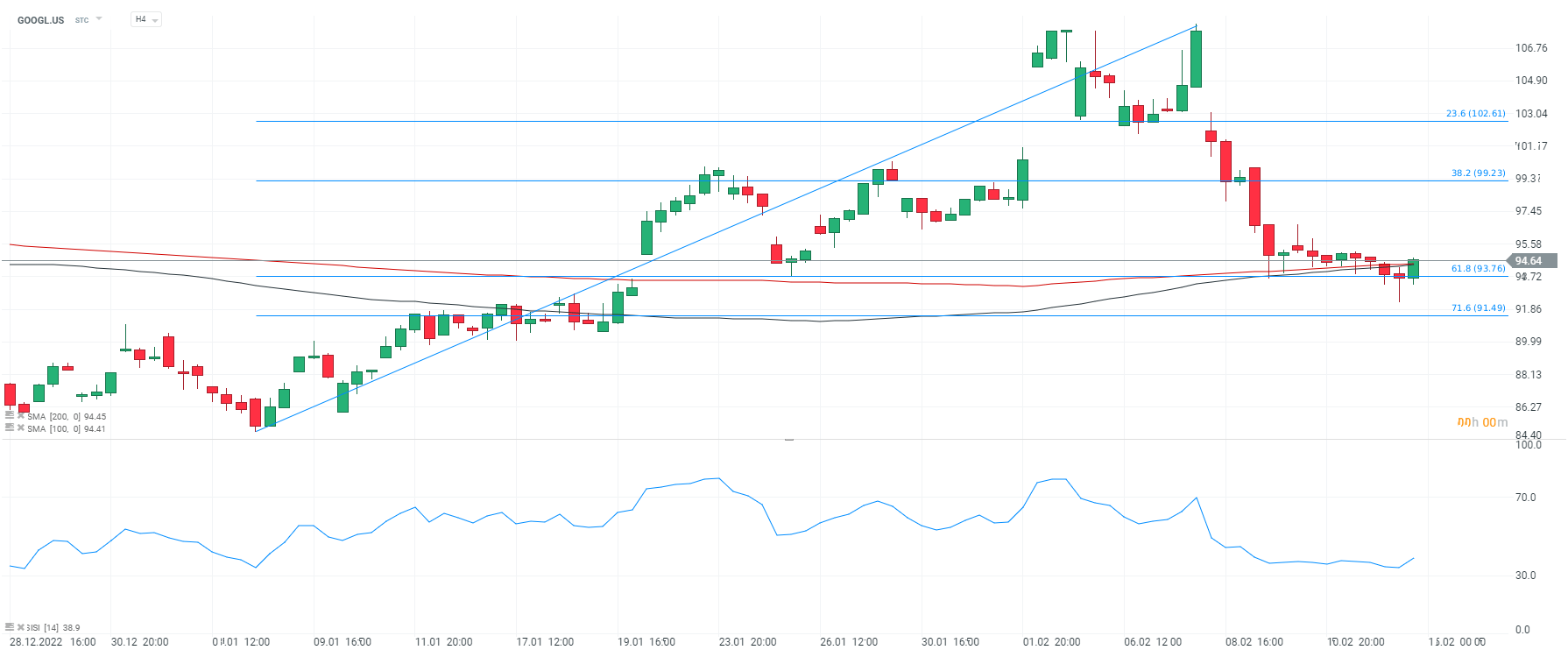

Alphabet (GOOGL.US) shares, H4 interval. Through the ‘Bard AI’ slip-up, Alphabet (Google) shares saw their biggest two-session decline since 2008. The bulls stopped the supply from the 71.6 Fibonacci retracement of the upward wave started in January, and the price returned above the SMA 200 (red line). The SMA100 and SMA200 averages are approaching an intersection in the form of a bullish ‘golden cross’ formation, signaling a possible return to growth. Source: xStation5

Article based on an analysis from XTB Research Department

Vezi cele mai recente știri & informații din piața de capital