Alătură-te comunității noastre!

Vezi cele mai recente știri & informații din piața de capital

China’s central bank, the PBoC, has injected more than CNY850 billion (cca $124 B) of net liquidity into the financial system from the 21st to the 29th of the month.

This includes CNY352bn injected through daily open market operations and CNY500bn by lowering the Required Reserve Ratio (RRR) which took effect on 27 March.

According to an analysis form ING bank, these operations are occurring at the end of the first quarter because the volatility in global financial markets is not over. There may be some ups and downs ahead.

In China, loan growth for the year is usually booked in the first three months. This is a seasonal phenomenon and pushes up interbank interest rates at the end of the first quarter.

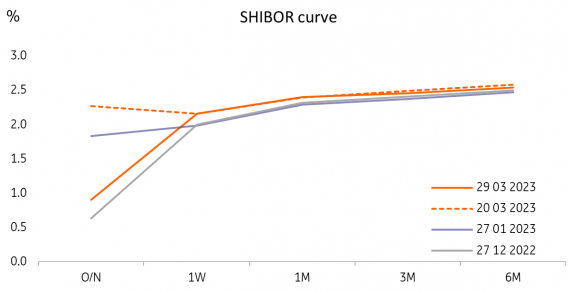

As the chart shows, the overnight SHIBOR touched 2.5% on 20 March, therefore, loan growth should continue to be very strong in March compared to 2022, even after the rapid growth in the first two months.

If this is the main reason for the PBoC’s big liquidity injection, this should be seen as a positive sign for economic growth.

China has a more open capital account than in the past and global events may have some impact on the Chinese market. As such, the PBoC may be cushioning any potential volatility. This is more of a precautionary measure and should not be over-interpreted.

Interbank interest rates show that liquidity was tight before the PBoC’s injection. Source: CEIC, ING

The market is discussing a rate cut

The market is actively discussing that the PBoC will cut the 7D policy rate and the medium-term lending facility (MLF) rate, which are currently at 2.0% and 2.75%, respectively. The discussion has intensified, especially after the PBoC announced a cut in the RRR this month.

But, at least for the moment, there is no need for China to lower interest rates. The economy is recovering at this time, although not as fast as the market expected though this is due more to the market’s overestimation of the speed of the rebound.

External markets are weakening and export activity will be dampened. But China’s interest rate cuts will not help exports. Moreover, an excessively accommodative monetary policy may attract some unnecessary investments.

As the economy recovers more quickly in the second half of the year, interest rate cuts could pose a risk of economic overheating.

Vezi cele mai recente știri & informații din piața de capital