Alătură-te comunității noastre!

Vezi cele mai recente știri & informații din piața de capital

In the second quarter 2022, seasonally adjusted GDP increased by 0.7% in the euro area and by 0.6% in the EU, compared with the previous quarter, according to a preliminary flash estimate published by Eurostat, the statistical office of the European Union.

In the first quarter of 2022, GDP had grown by 0.5% in the euro area and 0.6% in the EU.

Compared with the same quarter of the previous year, seasonally adjusted GDP increased by 4.0% both in the euro area and in the EU in the second quarter of 2022, after +5.4% in the euro area and +5.5% in the EU in the previous quarter.

Among the Member States for which data are available for the second quarter 2022, Sweden (+1.4%) recorded the highest increase compared to the previous quarter, followed by Spain (+1.1%) and Italy (+1.0%).

Declines were recorded in Latvia (-1.4%), in Lithuania (-0.4%) and in Portugal (-0.2%). The year on year growth rates were positive for all countries.

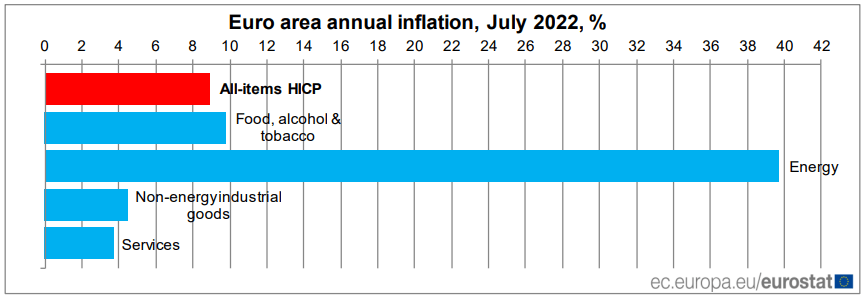

Meanwhile, Euro area annual inflation is expected to be 8.9% in July 2022, up from 8.6% in June according to a flash estimate from Eurostat, the statistical office of the European Union.

Looking at the main components of euro area inflation, energy is expected to have the highest annual rate in July (39.7%, compared with 42.0% in June), followed by food, alcohol & tobacco (9.8%, compared with 8.9% in June),

non-energy industrial goods (4.5%, compared with 4.3% in June) and services (3.7%, compared with 3.4% in June).

Also, the eurozone economy contracted in July, according to early PMI survey indicators, with output and new orders both falling for the first times since the COVID-19 lockdowns of early 2021.

Also, the eurozone economy contracted in July, according to early PMI survey indicators, with output and new orders both falling for the first times since the COVID-19 lockdowns of early 2021.

An accelerating downturn in manufacturing was accompanied by a near-stalling of service sector growth as the rising cost of living continued

to erode the tailwind of pent-up demand from the pandemic.

Concerns over the weakening of demand were exacerbated by energy, supply and inflation worries to push business expectations lower, and also cause a steep drop in input buying and a pull-back in hiring.

Price pressures meanwhile remained elevated at levels not seen prior to the pandemic, though rates of inflation of both selling prices and input costs moderated amid an easing of supply constraints and weakened demand.

The seasonally adjusted Composite Output Index fell from 52.0 in June to 49.4 in July, according to the ‘flash’ reading. By dropping below

the neutral 50.0 level, the July PMI signals a contraction of business output for the first time since February 2021.

The steepest decline was recorded in Germany, where the composite PMI of 48.0 sank to its lowest since June 2020. Although output continued to rise in France, the pace of growth slowed sharply as the composite PMI fell to 50.6 to register only a marginal improvement and the weakest expansion in 16 months.

The rest of the region as a whole meanwhile recorded a marginal contraction of output, the composite PMI dropping to 49.9 to represent the first deterioration since February 2021.

Vezi cele mai recente știri & informații din piața de capital