Alătură-te comunității noastre!

Vezi cele mai recente știri & informații din piața de capital

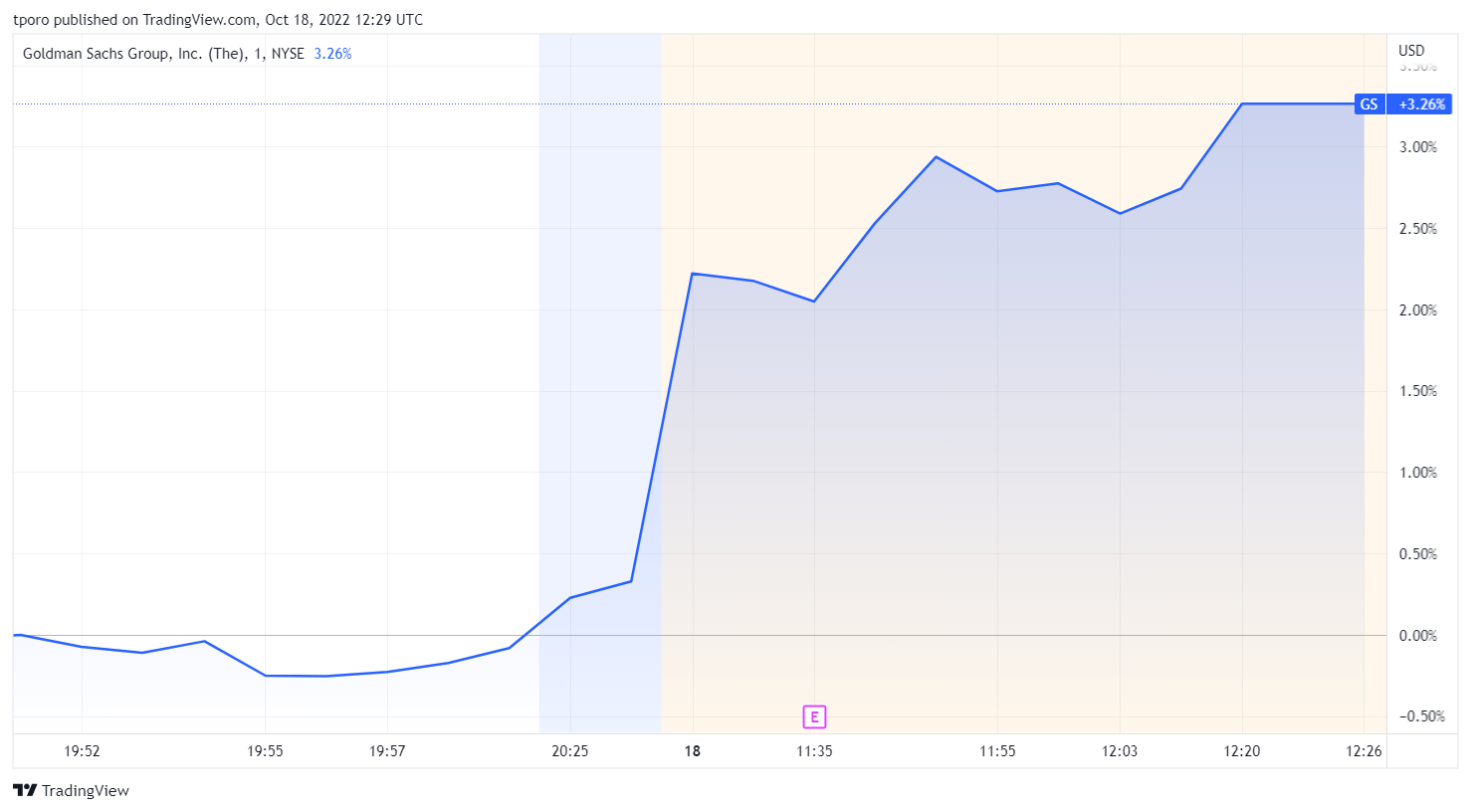

The Goldman Sachs Group, Inc. (NYSE: GS) today reported net revenues of $11.98 billion and net earnings of $3.07 billion for the third quarter ended September 30, 2022, a drop of 12% respectively 44%. From the begining of the year, Net revenues were $36.77 billion and net earnings were $9.94 billion.

Diluted earnings per common share (EPS) was $8.25 for compared with $14.93 last year and $7.73 for the second quarter of 2022, and was $26.71 for the first nine months of 2022.

Net revenues were 12% lower than a strong third quarter of 2021 and 1% higher than the second quarter of 2022. The decrease compared with the third quarter of 2021 reflected significantly lower net revenues in Investment Banking and Asset Management, partially offset by higher net revenues in Global Markets and Consumer & Wealth Management.

Net revenues in Investment Banking were $1.58 billion for the third quarter of 2022, 57% lower than a strong third quarter of 2021 and 26% lower than the second quarter of 2022. The decrease compared with the third quarter of 2021 reflected significantly lower net revenues in Underwriting, Financial advisory and Corporate lending.

The decrease in Underwriting net revenues was due to significantly lower net revenues in both Equity and Debt underwriting, reflecting a significant decline in industry-wide volumes.

The decrease in Financial advisory net revenues reflected a significant decline in industry-wide completed mergers and acquisitions transactions from elevated activity levels in the prior year period.

The decrease in Corporate lending net revenues was primarily due to net mark-downs on acquisition financing activities and net losses on hedges. The firm’s backlog was essentially unchanged compared with the end of the second quarter of 2022.

Net revenues in Global Markets were $6.20 billion for the third quarter of 2022, 11% higher than the third quarter of 2021 and 4% lower than the second quarter of 2022.

Net revenues in Asset Management were $1.82 billion for the third quarter of 2022, 20% lower than the third quarter of 2021 and 68% higher than the second quarter of 2022.

The decrease compared with the third quarter of 2021 primarily reflected significantly lower net revenues in Equity investments and Lending and debt investments, partially offset by significantly higher net revenues in Management and other fees.

Provision for credit losses was $515 million for the third quarter of 2022, compared with $175 million in the third quarter of 2021 and $667 million in the second quarter of 2022.

Provisions for the third quarter of 2022 reflected consumer portfolio growth, net chargeoffs and the impact of continued broad concerns on the macroeconomic outlook. The third quarter of 2021 primarily reflected provisions related to portfolio growth (primarily in credit cards).

The firm’s allowance for credit losses was $5.59 billion as of September 30, 2022.

“Goldman Sachs’ third quarter results reflect the strength, breadth and diversification of our global franchise. Against the backdrop of uncertainty and volatility in the markets, we continue to prudently manage our resources and remain focused on risk management as we serve our clients.

Importantly, we are confident that our strategic evolution will drive higher, more durable returns and unlock long-term value for shareholders.

In January 2020, we outlined our strategy in clear and direct terms, introducing a plan to grow and strengthen our core businesses, diversify our products and services, and operate more efficiently as we drive higher, more durable returns.

Today, we enter the next phase of our growth, introducing a realignment of our businesses that will enable us to further capitalize on the predominant operating model of One Goldman Sachs as we better serve our clients,” said David Solomon, CEO.

Vezi cele mai recente știri & informații din piața de capital