Alătură-te comunității noastre!

Vezi cele mai recente știri & informații din piața de capital

Johnson & Johnson (JNJ.US) stock jumped to two-month high after the drug and consumer products company posted solid figures for third-quarter 2022 thanks to rising demand of its cancer drug Darzalex and Crohn’s disease drug Stelara.

Company earned $2.55 a share, beating analysts’ estimates of $2.48 a share. Revenue of $23.8 billion also topped market projections of $23.4 billion. A year earlier, the company recorded a profit of $2.60 a share on sales of $23.3 billion.

Pharmaceutical sales rose 2.6% to $13.2 billion in Q3, topping forecasts of $12.89 billion. MedTech sales increased by 2.1% to $6.78 billion, and Consumer Health sales dropped 0.4% to $3.8 billion, still above Wall Street expectations of $3.72 billion. Sales of cancer drug Darzalex jumped 29.8% to $2.05 billion.

For 2022, the company narrowed its adjusted EPS guidance range to $10.02 to $10.07 from $10.00 to $10.10 but lowered its reported sales guidance to $93.0 billion to $93.5 billion from $93.3 billion to $94.3 billion.

Johnson & Johnson expects that inflation may ease next year but higher costs of products manufactured in 2022 could have a negative impact on 2023 results. Also stronger USD may lower 2023 adjusted earnings by between 40 cents and 45 cents.

“Our third quarter performance demonstrates our continued strength and resilience across all three of our businesses,” said Joaquin Duato, Chief Executive Officer.

“Through the ongoing efforts of our teams around the world, we continue to navigate the dynamic macroeconomic environment and remain focused on delivering transformative healthcare solutions. Looking ahead, I remain confident in our business and ability to continue advancing our innovative portfolio and pipeline.”

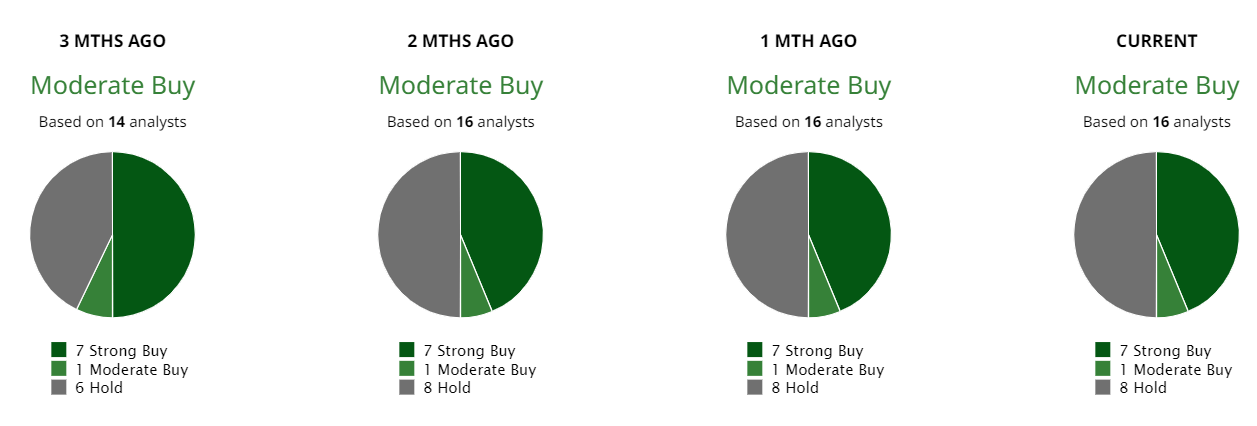

According to the issued ratings of 16 analysts, the consensus rating for Johnson & Johnson (JNJ.US) stock is Moderate Buy based on the current 8 hold ratings, 1 moderate buy and 8 strong buy. Source: Barchart

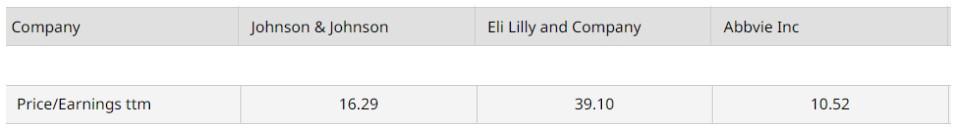

Johnson & Johnson (JNJ.US) has a moderate P / E TTM ratio compared to its competitors. Source: Barchart

Johnson & Johnson (JNJ.US) stock broke above major resistance zone around $166.50, which is marked with 38.2% Fibonacci retracement of the upward wave launched in March 2020, upper limit of the 1:1 structure and downward trendline.

Upbeat quarterly results provided more fuel for the rally and stock price is currently testing local resistance at $169.80, which is marked with previous price reactions.

Vezi cele mai recente știri & informații din piața de capital