Alătură-te comunității noastre!

Vezi cele mai recente știri & informații din piața de capital

Almost three years have passed since there was no bank failure in the US banking system, but this situation came to an unseemly end. Silicon Valley Bank, which counts among its customers half of all U.S. venture-capital backed startups, was taken into receivership by the Federal Deposit Insurance Corp on Friday after a slide in deposits and a hasty capital raising failed to restore confidence.

By acting quickly, regulators have stopped one crisis, but may have laid the groundwork for more.

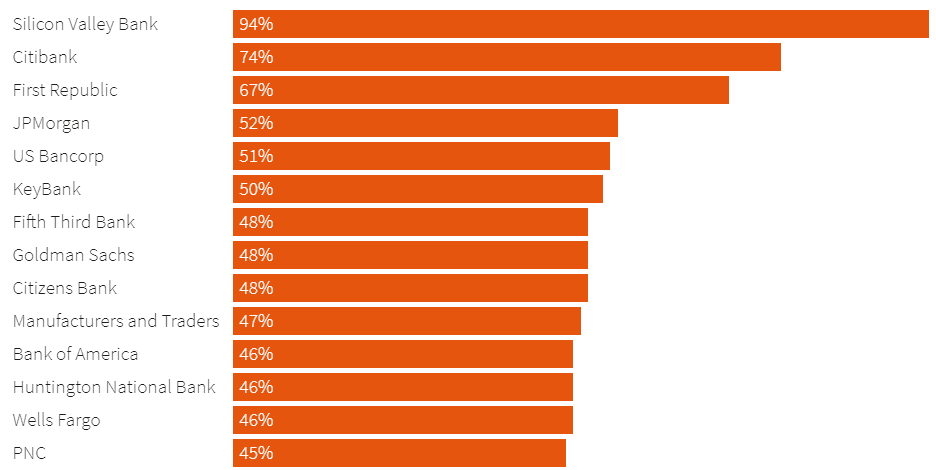

The bank owned by SVB Financial relied more heavily on large, and therefore, uninsured, deposits than other banks. Some 94% of the funds held at SVB weren’t guaranteed at the end of 2022, according to its regulatory filings, compared with 52% at JPMorgan, and 58% at Silvergate Bank, a crypto-focused lender that is also closing its doors this week after depositors turned tail.

SVB was also skewed towards young tech companies that burn through cash. As interest rates have risen and the economy has cooled, startups have been drawing down their deposits more swiftly than before. SVB thought the situation would improve at the end of last year but it was wrong.

American bank customers typically don’t have to worry about what happens if a lender goes under, thanks to a guarantee from Uncle Sam to pay back depositors if an institution fails, with one big exception: balances over $250,000 aren’t covered.

Above that level, customers must fight with other creditors for scraps.

The share of big U.S. banks’ domestic deposits that were not covered by the Federal Deposit Insurance Corp as of the end of 2022, based on regulatory filings known as call reports.

Depositors that exceed the $250k limit will now get a certificate entitling them to dividends – possibly – as SVB’s assets are sold off. They may in the end get most of their money back.

SVB’s assets were mostly cash and government-backed fixed-income securities at the last count, and of the loans that made up roughly one-third of its $212 billion balance sheet, most were in reasonably safe areas.

A buyer – say, a bank that covets SVB’s relationship with upwardly mobile entrepreneurs – might swoop in and buy the whole thing. But the uncertainty is still disastrous for startup customers who need regular and immediate access to large sums to keep their lights on.

Anyone with uninsured deposits is now, effectively, on notice that these balances aren’t guaranteed when push comes to shove. That message probably gets forgotten in peacetime.

And while few banks have the concentration of tech-sector risk that made SVB’s customers lose their nerve, many have a substantial reliance on deposits that are now revealed to be anything but rock solid.

If the regulators’ goal was to make mega-banks like JPMorgan and Bank of America even bigger, they couldn’t have found a better way.

Vezi cele mai recente știri & informații din piața de capital