Alătură-te comunității noastre!

Vezi cele mai recente știri & informații din piața de capital

Tesla reported financial results for the first quarter 2023 that came below estimates as the operating margin narrowed because of the cost reduction of vehicles.

The company reported total revenue of $23.32B up 24% year-over-year, but a 26% decline in income from operations and 24% decrease in net income.

But, Elon Musk wants to sell 1.8 million cars this year, 37% more than in 2022. First-quarter deliveries were up only 4% over the previous three months, which means they’ll need to average 9% higher for the rest of 2023 to meet the target.

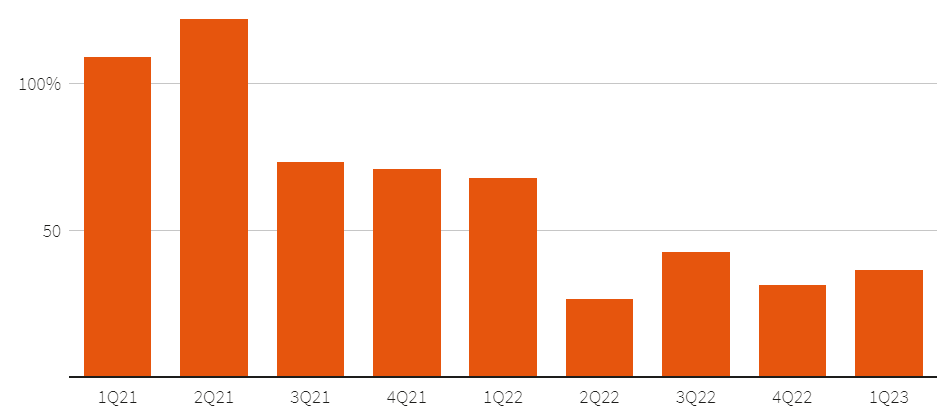

Year-over-year growth in Tesla’s vehicles delivered. Source Source: Company filings, J. Guilford | 04/19/2023. Reuters Breakingviews

With domestic competitors like Ford Motor throwing their full weight behind electric car development and Chinese manufacturers on the rise, growth will be even harder to achieve.

Musk is taking advantage of Tesla’s pole position and the leeway its profits provide to cut prices six times in the U.S. alone in recent months. That has had consequences:

Tesla’s automotive gross margin, net of revenue from regulatory credits, fell to 19% in the first quarter from 30% a year earlier.

A few things are having a positive effect on the $570 billion company. The U.S. government is increasing support for electric cars and introducing new emissions standards that will benefit Tesla more than established competitors that probably aren’t making money on electric models yet.

And the pandemic-triggered increase in microchip and raw material costs is leveling off. Based on the gap between Tesla’s credit-adjusted automotive sales and gross profit per car delivered, costs have fallen 10% since the recent peak.

Maintaining that momentum will be more difficult. Tesla believes it can cut the cost of new models by 50%, so a $25,000 car would be within reach.

A new, cheaper model would be a big step forward. BYD, for example, is introducing cars that cost as little as $11,600. Tesla’s aging model line has lost market share in recent years.

An even bigger problem involves Tesla’s biggest advantage: batteries. Together with its partners, Tesla is the market leader in energy storage and has been ahead of its competitors, who have relied on cheaper and more innovative technologies.

However, brands like BYD and Chery are expected to launch the first cars powered by a sodium-ion battery, a potentially breakthrough new chemistry that promises to lower prices even further.

The threat of becoming technologically obsolete adds to the pressure on Tesla. Having created the modern electric car market, Musk now faces the challenge of keeping up with it.

Vezi cele mai recente știri & informații din piața de capital