Alătură-te comunității noastre!

Vezi cele mai recente știri & informații din piața de capital

As the 31st of October deadline for Brexit nears, we look at the potential market impact of two possible scenarios: deal or no deal. In the stress-test scenarios made by MSCI, the investment research firm that provides indices, portfolio risk and performance analytics, a disruptive no-deal scenario could weaken the U.K. equity market by 15% and the GBP by 10% relative to the USD, as well as hurt corporate-bond markets.

If the U.K. and EU reach a last-minute deal, however, the U.K. equity market could gain by 10% and the GBP could rise by 8% relative to the USD, according to the same source.

Brexit has roiled markets after U.K. voters chose “leave” in the June 2016 referendum. Immediately, the pound plunged 8% against the U.S. dollar (as the exhibit below shows).

Since then, Brexit has turned into a political thriller, as underscored by yesterday’s news that Downing Street considers a deal unlikely. The pound is now 17% cheaper than prior to the referendum, and both U.K. and European equity markets have underperformed global markets.

„Our stress test suggests there is room for further losses if a no-deal Brexit occurs or — if a deal between the U.K. and European Union is struck before the Oct. 31 deadline — markets may rebound. Depending on the outcome, the impact on the U.K. equity market may range from -15% to +10%, while the pound might lose 10% or gain 8% relative to the U.S. dollar.,” according to an analysis made by MSCI.

How disruptive could a no-deal Brexit be for the equity and the bond markets?

For the first scenario, analysis outlined in the International Monetary Fund’s World Economic Outlook, the study acknowledges that the Brexit impact is already partially priced in, but that things could turn worse in the event of a no-deal Brexit.

In the IMF’s most severe scenario, the economy is disrupted by increasing tariff and nontariff trade barriers, border disruption and stricter immigration policies, with an adverse impact on economic growth.

Financial conditions in the U.K. and Europe would also tighten under this scenario, with both sovereign- and corporate-bond spreads rising as confidence drops, although the effect on sovereigns would be partially offset by monetary easing.

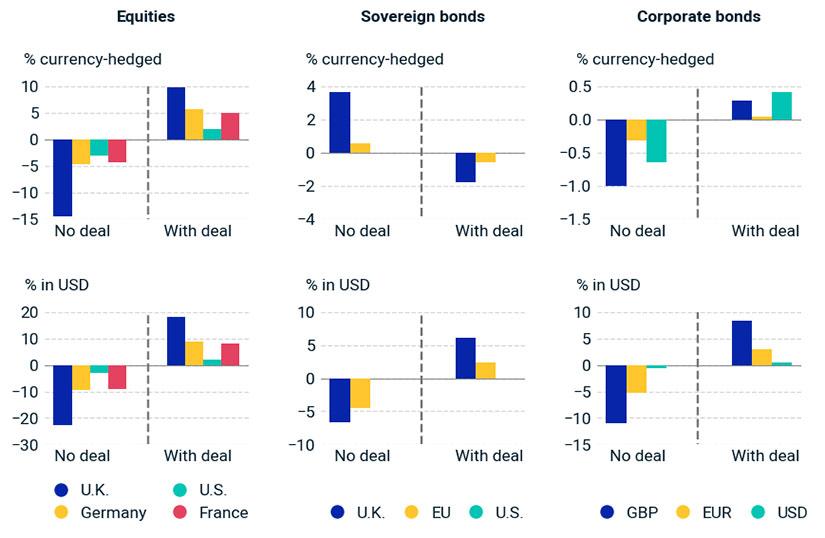

The proposed market impacts for this scenario are shown in the exhibit below. In short, equity markets would drop, with the U.K. bearing the largest impact. Sovereign yields would decrease in the U.K. and Europe, while corporate spreads would widen. Both the pound and euro would lose value relative to the dollar.

But what happens if a deal is struck?

Without commenting on the likelihood of a deal, it remains possible the U.K. will strike a deal with the EU. In such a case, MSCI’s analysts scenario envisions a (partial) reversal of what has been priced in over the past two years: Equity markets could rebound, with the U.K. outperforming European and U.S. equity markets; the pound and euro could strengthen against the dollar; and corporate spreads could tighten.

„We further assume that — along with the positive surprise to future expected growth — sovereign bonds may lose, as rates go slightly up„.

How are equity and bond markets impacted?

The exhibit below shows the impact on the hypothetical portfolios in local-currency and USD terms. Equity and corporate-bond markets would lose under the no-deal scenario and gain under the deal scenario, with the USD returns amplified in either direction due to the pound-dollar exchange-rate change. U.K. and European sovereign bonds would rally or lose value under the no-deal and deal scenarios, respectively, while U.S. sovereign debt is unaffected under both scenarios.

We approximate the hypothetical equity portfolio with the MSCI ACWI Index (and look at a country breakdown). The hypothetical U.K., euro and U.S. sovereign-bond portfolios are proxied by the Markit iBoxx GBP Gilts Index, the Markit iBoxx EUR Eurozone Index and the Markit iBoxx USD Treasuries Index, respectively. The U.K., euro and U.S. corporate-bond portfolios were constructed by the authors, using globally accepted selection criteria.

As the Brexit deadline approaches, investors can prepare for the possible outcomes. Markets have already partially priced in Brexit, but they could move in either direction — all depending on the nature of the exit.

[ajax_load_more]

Vezi cele mai recente știri & informații din piața de capital