Alătură-te comunității noastre!

Vezi cele mai recente știri & informații din piața de capital

In his annual letter to JPMorgan shareholders this month, Jamie Dimon suggested that when his investors see the American flag, they should say thank you.

The original thought may have come from Berkshire Hathaway CEO Warren Buffett, but Dimon was absolutely right to apply it to the banking sector as well.

JPMorgan, Wells Fargo, Citigroup and PNC Financial Services all reported a jump in first-quarter profits Friday, largely due to the unprecedented rise in U.S. interest rates over the past year.

Dimon’s company averages a 4.7% return on interest-earning assets, while the cost of interest-bearing deposits is only 1.9%. JPMorgan has passed on only 40% of the increase in benchmark interest rates to savers.

Wells Fargo managed to keep even more for itself, passing on only 26%.

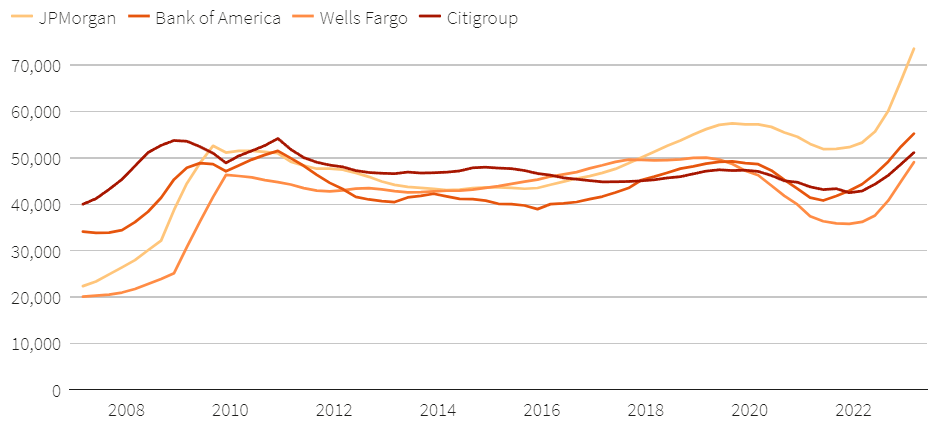

Net interest income at the largest U.S. banks, on a rolling four-quarter basis, millions of U.S. dollars. Source: Refinitiv | John Foley | Reuters Breakingviews | April 14 2023

The big banks are operationally complex, but for earnings purposes they’re essentially interest income machines. Dimon’s bank raised its target for net interest income this year by nearly 10% to $81 billion and said it’ll stay above $70 billion for a while.

That’s not just a record – it’s more than the bank’s entire revenue in 2007, the last time interest rates were this high. And it’s at negligible cost: JPMorgan hasn’t changed its spending forecast for this year.

All this makes it easier to ignore less flattering developments, such as the 19% year-on-year decline in investment banking fees and stagnant trading revenues, a trend largely repeated at Citi.

A string of bankruptcies at mid-sized banks hasn’t rattled the majors either. U.S. lenders lost a total of $600 billion in deposits in the first quarter of the year, but JPMorgan’s balances were up a net $33 billion.

Chief Financial Officer Jeremy Barnum estimates that $50 billion in deposits flowed into his bank and stayed there, more than offsetting other outflows. PNC’s deposits were unchanged.

Wells Fargo’s deposits fell, but a 2% decline isn’t bad for a lender that has been defrauding its customers for years.

The leaders of these companies – Dimon, Citi chief Jane Fraser and Bank of America chief Brian Moynihan, who will announce his results next week – deserve credit, which they receive in the form of generous compensation packages.

But the real credit belongs to their monetary policy and regulatory team. It’s the Federal Reserve that has ensured rising interest rates, low customer defaults, and capital and liquidity buffers that make failure of these banks unimaginable.

Elsewhere in Dimon’s letter, he describes himself as a „full-blooded, patriotic, free enterprise, free market capitalist” That may appeal to investors, but his bank’s profits show that other forces are at work.

Context

JP Morgan reported Net revenue of $39.3 billion, up 25% in the first quarter. Net interest income (NII) was $20.8 billion, up 49%. NII excluding Markets was $20.9 billion, up 78%, predominantly driven by higher rates, partially offset by lower deposit balances compared to the prior year. Noninterest revenue was $18.5 billion, up 5%, predominantly driven by higher CIB Markets noninterest revenue, largely offset

by higher net investment securities losses in Corporate and lower Investment Banking fees and operating lease income in Auto.

Wells Fargo′s Net interest income increased 45%, primarily due to the impact of higher interest rates, higher loan balances, and lower mortgage-backed securities premium amortization, partially offset by lower deposit balances. Noninterest income decreased 13%, driven by lower results in affiliated venture capital and private equity businesses; a decline in mortgage banking income on lower originations and gain on sale margins, as well as lower gains from the resecuritization of loans purchased from securitization pools; lower asset-based fees in Wealth and Investment Management on lower market valuations; and lower deposit-related and investment banking fees. These decreases were partially offset by improved results in our Markets business.

Citigroup today reported net income for the first quarter 2023 of $4.6 billion, or $2.19 per diluted share, on revenues of $21.4 billion. This

compares to net income of $4.3 billion, or $2.02 per diluted share, on revenues of $19.2 billion for the first quarter 2022.

Vezi cele mai recente știri & informații din piața de capital