Alătură-te comunității noastre!

Vezi cele mai recente știri & informații din piața de capital

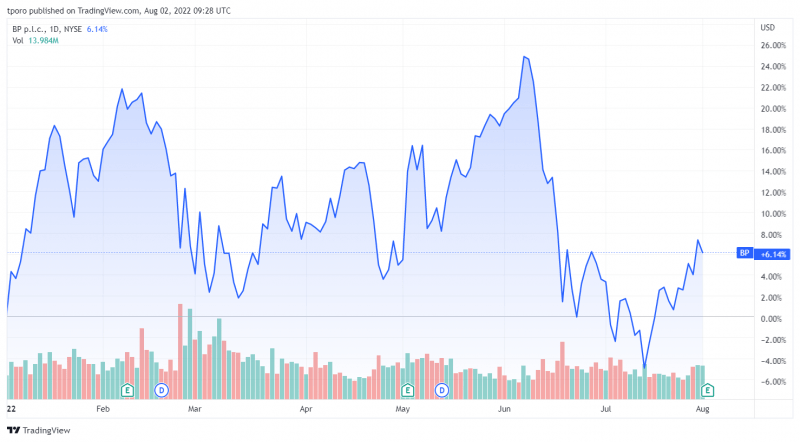

Giant oil&gas company BP reported a net profit in the second quarter of $9.3 billion compared with $3.1 billion in the same period of 2021 largely as a result of higher realizations. Thus, the loss attributable to bp shareholders in the half year was $11.1 billion compared with a profit of $7.8 billion in the same period of 2021.

Underlying replacement cost profit was $8.5 billion, compared with $6.2 billion for the previous quarter. This was driven by strong realized refining margins, continuing exceptional oil trading performance and higher liquids realizations.

This was partly offset by an average gas marketing and trading contribution, down from the exceptional result in the first quarter, including an impact from the ongoing outage at Freeport LNG.

Operating cash flow in the quarter was $10.9 billion, including $1.2 billion of Gulf of Mexico oil spill payments within a working capital build of $2.9 billion.

During the second quarter BP executed share buybacks of $2.3 billion. The $2.5-billion programme announced with the first-quarter 2022 results was completed on 22 July. Net debt fell for the ninth successive quarter to reach $22.8 billion at the end of the second quarter.

Today’s results show that bp continues to perform while transforming. Our people have continued to work hard throughout the quarter helping to solve the energy trilemma – secure, affordable and lower carbon energy. We do this by providing the oil and gas the world needs today – while at the same time, investing to accelerate the energy transition, said Bernard Looney, Chief executive officer.

Looking ahead, on average, based on BP’s current forecasts, BP continues to expect to have capacity for an annual increase in the dividend per ordinary share of around 4% through 2025 at around $60 per barrel Brent and subject to the board’s discretion each quarter.

During the second quarter bp generated surplus cash flow of $6.6 billion and intends to execute a $3.5 billion share buyback prior to announcing its third-quarter results. BP has now announced share buybacks from 2021 and first-half 2022 surplus cash flow equivalent to 60% of the cumulative surplus cash flow.

For 2022 the company maintains a strong investment grade credit rating, and remains committed to using 60% of surplus cash flow for share buybacks and intends to allocate the remaining 40% to further strengthen the balance sheet.

Vezi cele mai recente știri & informații din piața de capital