Alătură-te comunității noastre!

Vezi cele mai recente știri & informații din piața de capital

First Quarter 2023 revenues increased 4% compared to the prior year and 10 percent on a currency-neutral basis, led by NIKE Direct growth of 14 percent.

NIKE Brand Digital business fueled growth, increasing by 23 percent, driven by double-digit growth in EMEA, North America and APLA, partially offset by declines in Greater China.

Wholesale revenues increased 1 percent on a reported basis and were up 8 percent on a currency-neutral basis, with growth due to improved levels of available supply of inventory for partners.

Revenues for Converse were $643 million, up 2 percent on a reported basis and up 8 percent on a currency-neutral basis, led by double-digit growth in North America and Europe, partially offset by declines in Asia.

Gross margin decreased 220 basis points to 44.3 percent, primarily driven by elevated freight and logistics costs, lower margins in NIKE Direct business driven by higher markdowns, and unfavorable changes in net foreign currency exchange rates, including hedges, partially offset by strategic pricing actions.

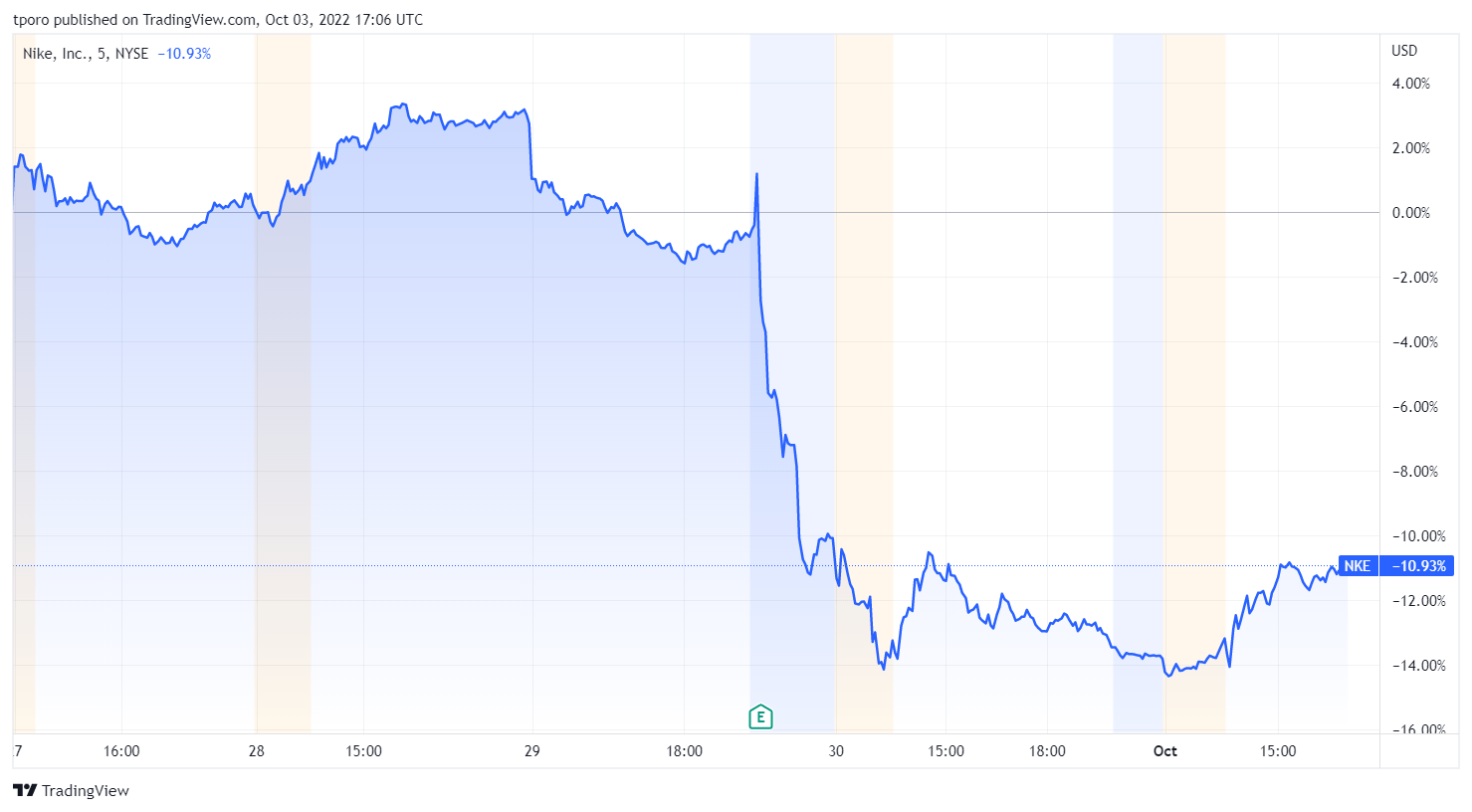

The overall decrease in margins was primarily driven by North America, which took measures to liquidate excess inventory through NIKE Direct markdowns and wholesale marketplace actions. Due to this, Nike’s shares fell more than 10% after the publication of quarterly results.

Selling and administrative expense increased 10 percent to $3.9 billion. Demand creation expense was $943 million, up 3 percent, primarily due to normalization of spend against sports marketing and brand campaign investments.

Operating overhead expense increased 12 percent to $3.0 billion, primarily due to wage-related expenses, strategic technology investments and increased NIKE Direct costs.

Inventories were $9.7 billion, up 44 percent compared to the prior year period, driven by elevated in-transit inventories from ongoing supply chain volatility, partially offset by strong consumer demand during the quarter.

Cash and equivalents and short-term investments were $11.9 billion, down approximately $1.8 billion from last year, as free cash flow was offset by share repurchases and cash dividends.

Net income was $1.5 billion, down 22 percent, and Diluted earnings per share was $0.93, decreasing 20 percent.

NIKE continues to have a strong track record of investing to fuel growth and consistently increasing returns to shareholders, including 20 consecutive years of increasing dividend payouts. In the first quarter, NIKE returned approximately $1.5 billion to shareholders, including:

• Dividends of $480 million, up 11 percent from the prior year.

• Share repurchases of $1.0 billion

Vezi cele mai recente știri & informații din piața de capital