Alătură-te comunității noastre!

Vezi cele mai recente știri & informații din piața de capital

Brent price dropped around 9% since the beginning of 2023, but price decline over the past 12 months is already exceeding 30%. Taking a look at the whole post-pandemic recovery move, crude prices currently trade near a midpoint.

While it looked like undersupply and increasing demand could be a problem, those concerns turned out to be unnecessary. A strong bearish trend can be observed on the oil market since June 2022 and the latest issues in the banking sector may have resembled the 2007-2009 financial crisis when crude prices quickly plunged from $150 to less than $40 per barrel.

Could history repeat itself? Will cheap oil turn out to be a remedy for a number of current issues? Are we set for further price drops in the later part of the year or will oil recover?

Is oil cheap already?

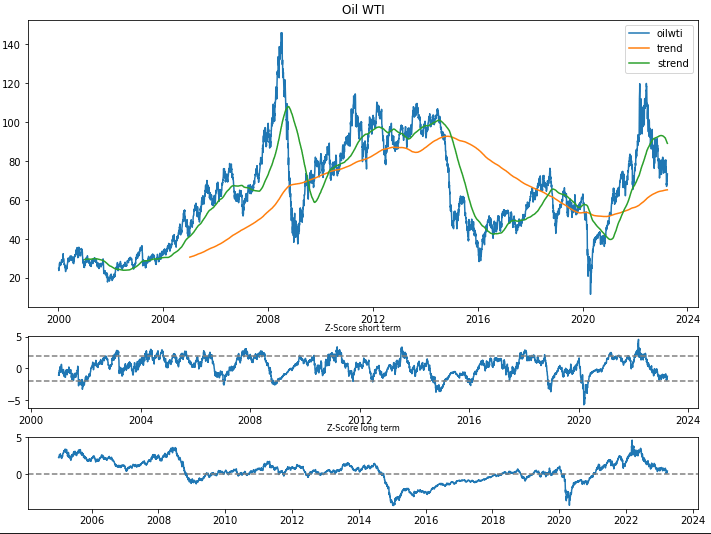

Brent and WTI are currently trading in a $70-80 per barrel range. Taking a look at the 5-year moving average, oil seems to be priced in-line but a look at the 1-year moving average shows that it is trading around 2 standard deviations below mean, which may hint at oil being oversold in the short-term.

On the other hand, looking at a longer horizon, there is still some room for prices to fall. Bloomberg points out that the current price is still too high given the relatively high probability of US recession.

According to the news agency, there is a high chance of barrel price dropping below $50 should a recession indeed arrive in the United States.

Oil looks to be oversold in the short-term but longer-term measures hint that it is priced in-line. Source: Bloomberg, XTB

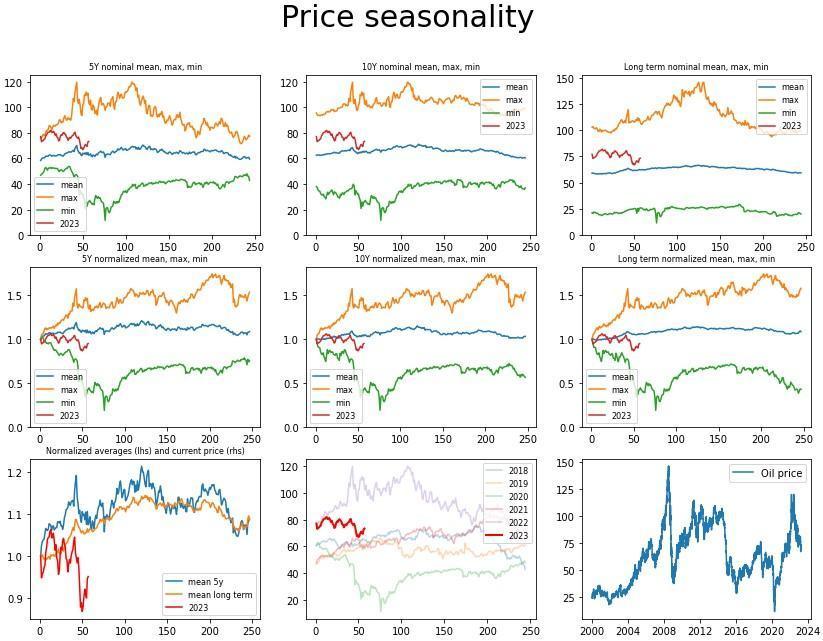

Taking a look at seasonal patterns, oil seems to be significantly oversold, especially when we take a look at 5-year and long-term patterns.

On the other hand, taking a look at the worst year in terms of performance in the past 5 years or even longer, oil still has some room to fall, especially in the first 4 months of the year (January-April period).

It is often the case that when the first third of the year is bad for prices, the second third is usually significantly better (May-August).

Seasonality for the oil market. Oil is having a bad start to the year but it does not mean that the worst is already behind. Source: Bloomberg, XTB

Will cheap oil be a remedy for current global issues?

Spare for the Ukraine war and ongoing banking crisis, cheaper oil could actually be a remedy for a number of global issues. A further drop in oil prices would accelerate a drop in inflation, which not only would limit future rate hikes, but may also bring forward rate cuts.

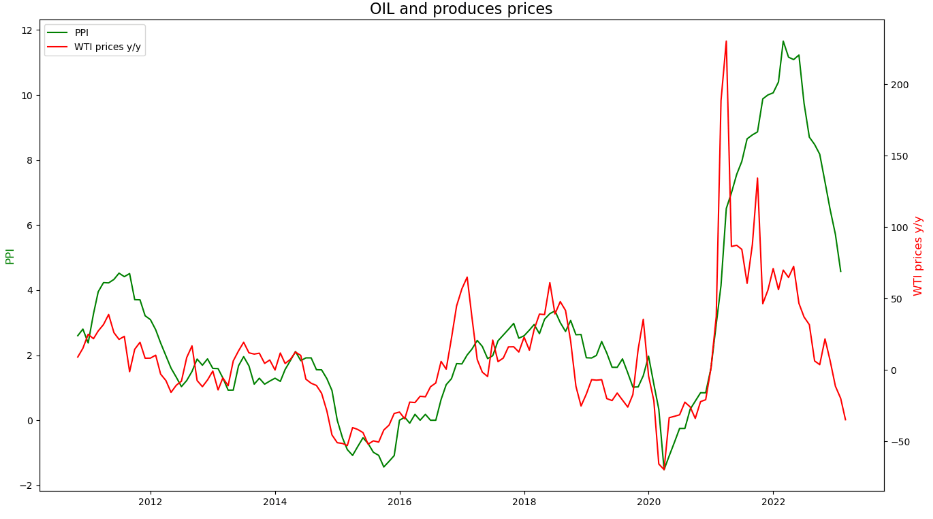

US producer’s inflation reacted quickly and steeply to a year-over-year decline on the oil market.

Lower oil prices may help avoid some of the economic issues but at the same time they may be driven by a potential economic crisis that is currently unfolding.

Change in oil prices suggests that PPI inflation may continue to drop to as low as 0% YoY! Source: Bloomberg, XTB

Is there a chance for further price declines?

Oil has recovered a bulk of the losses triggered by the recent banking crisis. Nevertheless, a look at fundamentals suggests that price declines may resume and continue.

Supply did not drop as much as feared as Russia managed to find markets for its oil. China continues to use its own stockpiles and does not increase imports.

This may also lead to a further build-up in US oil inventories. Comparative inventories (nominal change in inventory level over 1 year) could be an important indicator here.

It is currently pointing to possibility of further price declines and „strongly oversold” signal will not surface until inventories climb to 80-100 million barrels above year ago levels.

Unless an economic crisis arrives, there is a chance for price recovery in the second half of the year – oil drilling rigs data suggests that US production is nearing peak output and inventories in China will run out at some point.

Oil recovered noticeably but continues to trade in a downtrend. A break above 50- and 100-session moving average, and a break above the upper limit of Overbalance structure later on, would brighten the outlook for oil bulls. However, the outlook for oil remains bearish for now.

Vezi cele mai recente știri & informații din piața de capital