Alătură-te comunității noastre!

Vezi cele mai recente știri & informații din piața de capital

The interest rate is the cost of credit or the return on savings. If a person borrows from a bank, then the interest rate is what they pay for their loan. When saving at a bank, interest is the return the person receives on their savings.

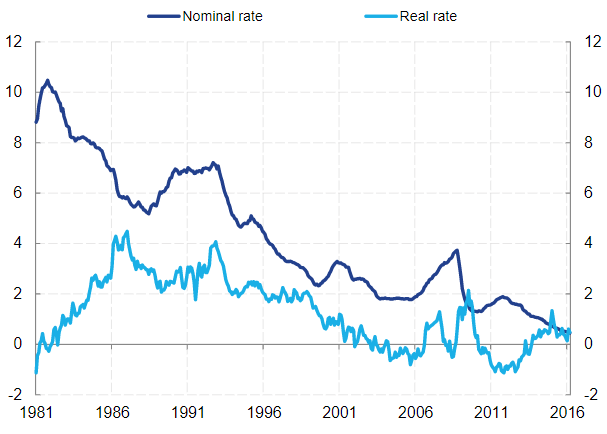

Economists distinguish between “nominal” and “real” interest rates, but what is the difference between the two and why does it matter?

The nominal rate of interest is the rate that is agreed and paid. For example, it’s the rate homeowners pay on their mortgage or the return savers receive on their deposits. Borrowers pay the nominal rate and savers receive it.

However, it’s not only the nominal payment that is important to both borrowers and savers, but also how many goods, services or other things they could buy with the money. Economists call this the purchasing power of money, which usually decreases over time as prices rise due to inflation.

Subtracting this loss of purchasing power from the nominal interest rate enables borrowers and savers to determine the real interest rate on their loans and savings.

Example

A saver who deposits €1,000 in an account for one year may get a nominal rate of interest of 2.5%, and thus receive €1,025 in a year’s time. However, if prices increase by 3%, he or she will need €1,030 to purchase the same goods or services that, one year earlier, would have cost €1,000. This means that the real return will actually have been -0.5%. This is the real interest rate, and it is calculated by subtracting the rate of inflation (3%) from the nominal interest rate (2.5%).

Nominal and real interest rates on short-term bank deposits in euro area countries. Source: Eurostat, ECB, NCBs, ECB estimates

For more explainers please visit Term of the day and Financial Quizzes

With courtesy of ECB

[ajax_load_more]

Vezi cele mai recente știri & informații din piața de capital