Alătură-te comunității noastre!

Vezi cele mai recente știri & informații din piața de capital

„Global debt surged by $7.5 trillion in H1 2019, hitting a new record of over $250 trillion and with no sign of a slowdown, largely driven by the U.S. and China,” according to the Global Debt Monitor, issued by Institute of International Finance.

Moreover, global debt is on track to exceed $255 trillion in 2019, spurred by looser financial conditions, the ballooning global debt load increased by $7.5 trillion in H1 2019—and now hovers near a new record of over $250 trillion (320% of GDP).

„China and the U.S. accounted for over 60% of the increase. Similarly, Emerging Markets debt also hit a new record of $71.4 trillion (220% of GDP). With few signs of slowdown in the pace of debt accumulation, we estimate that global debt will surpass $255 trillion this year„.[emaillocker]

Key facts:

• Debt outside the financial sector hits $190 trillion: With non-financial sector debt rising faster than global economic activity, the world’s debt pile (ex-financials) now tops 240% of GDP (or $190 trillion). Across sectors,

government debt (+1.5%pts) saw the biggest rise in H119, followed by non-financial corporates (+1%pt). According to the report, it’s estimated that global government debt will top $70trn in 2019, up from $65.7trn in 2018—driven mainly by the surge in U.S. federal debt. With net borrowing by the Chinese corporate sector on the rise again, we expect global non-financial corporate debt to rise by 6% to over $75 trillion this year

• Watch out for contingent liabilities: The big increase in global debt over the past decade—over $70 trillion—has been driven mainly by governments and the non-financial corporate sector (each up by some $27 trillion). For mature markets, the rise has mainly been in general government debt (up $17 trillion to over $52 trillion). However, for emerging markets the bulk of the rise has been in non-financial corporate debt (up $20 trillion to over $30 trillion). Moreover, available data suggest that state-owned enterprises (SOEs) now account for over half of EM non-financial corporate debt—meaning that sovereign-related borrowing has been the single most important driver of global debt over the past decade. This trend also highlights the challenges many EM governments are likely to face in managing contingent liabilities related to SOE borrowing.

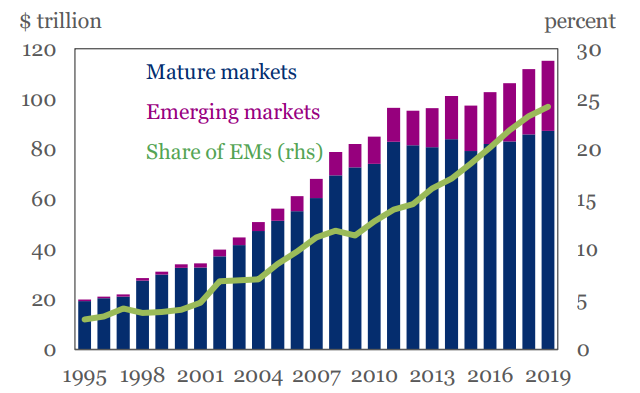

EMs account for nearly one-quarter of the global bond universe—up from 11% in 2009. Source: IIF, BIS, IMF

• Limits to debt-fueled growth: With over 60% of the world’s countries expected to see below-potential growth in 2020, accommodative central bank policy allows both corporates and sovereigns to borrow and refinance at low

rates. However, with diminishing scope for further monetary easing in many parts of the world, countries with high levels of government debt (Italy, Lebanon)—as well as those where government debt is growing rapidly (Argentina, Brazil, South Africa, and Greece)—may find it harder to turn to fiscal stimulus. Moreover, investor appetite for funding the corporate sector in high-debt countries is sensitive to shifts in global risk sentiment; if this appetite wanes, it could weigh on capex and new job creation. With FX debt in EMs at record highs, greater reliance on FX borrowing in some countries (Argentina, Saudi Arabia, Turkey, Mexico, Chile) could exacerbate the risks if growth slows further.

• Bond issuance fuels global debt accumulation: A striking feature of the past decade has been the rapid growth of capital markets. With the size of global bond markets increasing from $87 trillion in 2009 to over $115 trillion in mid-2019, debt securities (mainly bonds) at present compose 56% of global debt outside the household sector— broadly stable at 2009 levels. Market growth has been most evident in government bonds—which now make up 47% of global bond markets compared to 40% in 2009. (In contrast, deleveraging has brought the share of bonds issued by financial institutions to below 40% from over 50% in 2009). The bond universe has grown most rapidly in emerging markets, swelling by over $17 trillion to near $28 trillion since 2009. Bonds now account for over 47% of EM debt (ex-households), up from 43% in 2009.

• High debt burdens could curb efforts to tackle climate risk: Global climate finance flows remain far short

of what’s needed for an effective transition to a low-carbon economy. Total global issuance of sustainable loans and

securities to date amounts to slightly over $1 trillion: for context, the IPCC estimates suggest that an average of $3.5

trillion ($3 trillion) in 2010 U.S. dollars is needed annually to prevent global temperatures from increasing 1.5 (2.0) degrees Celsius by 2050. To achieve this goal, public and private climate finance flows will have to be scaled up rapidly. This is a growing source of concern for high-debt countries that also have high exposure to climate risk (e.g. Japan, Singapore, Korea and even the U.S.). Climate-vulnerable countries with weak tax bases will face even more challenges: in emerging markets these include India and South Africa; among low income countries The Gambia, Zambia, and Tanzania standout Lack of transparency in some cases—associated with “hidden debt” and/or poorly understood contingent liabilities—creates additional uncertainty and risks; and could leave some sovereigns struggling to source international and domestic capital—including to combat climate change.

Source: Institute of International Finance[/emaillocker]

[ajax_load_more]

Vezi cele mai recente știri & informații din piața de capital