Alătură-te comunității noastre!

Vezi cele mai recente știri & informații din piața de capital

Global equity markets kicked off the year on the right foot, extending gains of the new bull market which started almost exactly a year ago. However, the market setup has changed considerably over the last couple of months.

In 2020, the global economy slid into an unforeseen recession as governments tried to stop the coronavirus from spreading by imposing nationwide lockdowns and mobility restrictions. Accordingly, equity indices fell at a speed barely seen before, bringing to an end the longest bull market in history.

However, thanks to the swift actions taken by major central banks and governments, investors quickly turned more positive. The flood of liquidity and fiscal support resulted in an increased demand for assets on financial markets, bidding up prices for stocks and bonds.

The S&P 500 dropped by more than 30% between February 19th and March 23rd 2020. Since then, the index increased by more than 60% from the bottom. Source: Bloomberg

Accommodative monetary policies all around the world drove global yields to historically low levels. In the US, 10 year yields hit an all-time low of 0.51% in August, and many eurozone countries are currently able to issue debt at negative yields.

While low interest rates were helpful for equity indices especially in the US, beneath the surface there was a huge divergence in performance between the various sectors. The more cyclical segments of the stock market, e.g. banks and energy, hovered around their lowest level in decades.

The main beneficiaries of the pandemic came mostly from the US tech sector, which carries a significant weight in the S&P 500.

The shift towards working and seeking entertainment from home boosted the shares of companies whose products meet such demand, e.g. Netflix, Zoom and Logitech, among many others. In the initial phase of the recovery, an uncertain economic environment, paired with a high amount of liquidity resulted in investors chasing only certain parts of the stock market, like the previously mentioned tech-names or companies engaging in renewables.

The tech-heavy Nasdaq index gained more than 40% in 2020, and this includes the sharp drop in prices at the beginning of the pandemic. Cyclical and so-called value stocks were largely avoided even months after the S&P 500 started climbing higher.

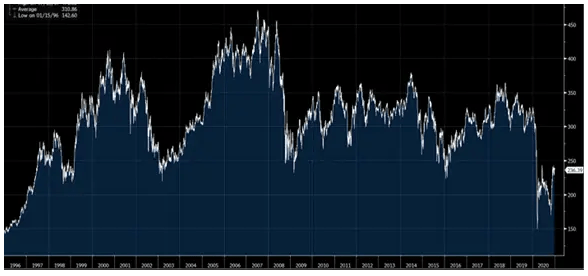

Last year`s bottom in the Stoxx 600 Oil & Gas index marked the lowest level since 1996. Source: Bloomberg

Vaccines marked the start of the sector rotation

The shift in sector performance came in the 4th quarter last year, when it became clear that the approval of the first vaccines was approaching. This news brought about a change in market sentiment, as investors started focusing on those sectors which had the most to gain from life returning back to normal, e.g. banks, autos, travel, etc.

At that time, many of the FAANG (Facebook, Amazon, Apple, Netflix and Google) stocks – all beneficiaries of the pandemic induced lockdowns – reached all-time highs and have traded below those levels ever since.

Joe Biden’s victory added to the sector rotation into cyclicals as his election promises were regarded by investors as reflationary, including a significant sum pledged for fiscal stimulus and green infrastructure investments.

On top of that on January 5th this year, Democrats unexpectedly gained control over the Senate, which resulted in an increased probability of Biden’s plans becoming reality.

So eventhough the year-to-date performance of equities at first might seem like a continuation of the strong equity performance of the last 12 months, the reality is that the ranking of relative winners and losers has changed dramatically.

Optimism around the vaccination, combined with a very loose monetary policy and increased fiscal spending especially in the US brought cyclicals and value stocks back into favor.

Higher yields and their consequences for equities

Many factors point towards a strong economic rebound for the world economy in 2021. There is huge pent-up demand from customers, savings rates in many regions are at high levels thanks to government support, and economies and tourism should reopen slowly but surely as the vaccination progresses.

As the Fed so far does not seem to be worried about a sustainable uptick in inflation, investors are testing the central bank`s limits by selling off bonds and driving yields higher.

Broadly speaking, higher yields can be read in two ways: Long-term yields reflect economic growth expectations, therefore a rise in yields means that investors expect growth to accelerate, which is a positive.

However, yields are also correlated to inflation expectations. If the latter rises, yields do too. Achieving the Fed’s inflation target of 2% would be a positive, but if inflation overshoots, the selloff in bonds can be expected to continue.

10 year yields in the US have increased more than 70 basis points year to date and more than 100 bp from their historic lows. In Europe, the German bund yield is also up since the start of the year, though not in the same amount as its US counterpart.

Higher yields put pressure especially on stocks with lofty valuations, many of which belong to the so-called growth category. The reason for this is that earnings of these companies are long duration, meaning that due to their strong projected growth rate, earnings are expected to be a lot higher in the distant future.

However, if rates rise, the present value of distant earnings decreases because of higher discount rates.

The most vulnerable segments of the market are those which fared the best in the initial phase of the recovery, namely big tech and renewables.

For this reason, the tech-heavy Nasdaq index is only up around 1% this year whereas the industrial-heavy Dow Jones gained more than 7%. Cyclically exposed sectors like banks, energy or autos have an advantage in this environment as their earnings are short duration, meaning that earnings react quickly to the improved economic environment and are less affected by higher interest rates.

So far this year, we have seen a strong outperformance of cyclical and value stocks. In terms of regional performance, Europe has been outperforming the US in 2021, thanks to its higher exposure to cyclical industries.

Where do we go from here?

Currently, the most likely scenario is that cyclical and value stocks will continue their relative outperformance. Worldwide, economic growth forecasts have been upgraded recently and earnings forecasts point to a strong increase by double digit percentage points in both the US and Europe.

If the vaccination program continues successfully and proves to be efficient also against newer variants of the coronavirus, then everything points toward a strong rebound in economic activity especially in the second half of the year.

Author Tamas Menyhart, Senior Fund Manager, with the courtesy of Erste Asset Management as copyright owner

Vezi cele mai recente știri & informații din piața de capital