Alătură-te comunității noastre!

Vezi cele mai recente știri & informații din piața de capital

Goldman Sachs, one of the leading investment banks on Wall Street, told their investors that ECB is expected to raise interest rates by 75 bps next week at its policy meeting, given the fact that eurozone inflation hit a new record high in august.

Many ECB bankers are pointing to this scenario, Robert Holzmann who’s also the governor of the Austrian central bank, indicated that 50 bps is the minimum, while 75 is very likely.

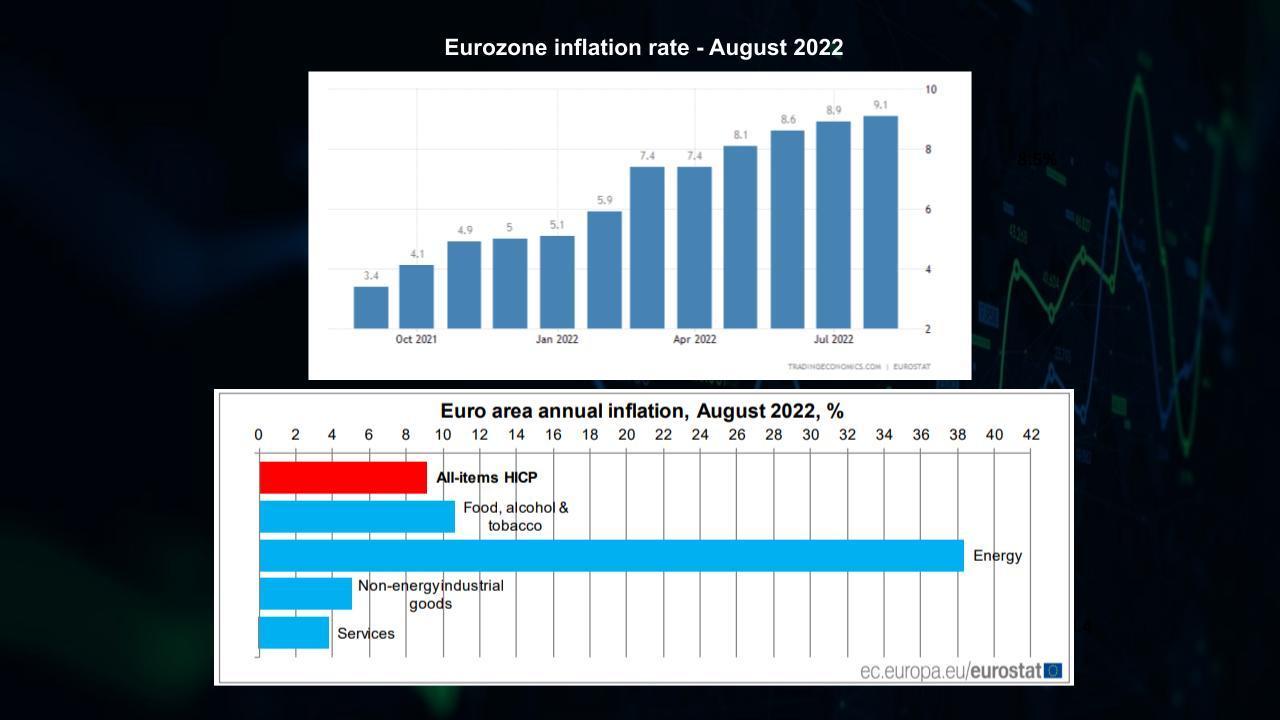

Also, earlier during Jackson Hole, there was a lot of talk from the ECB that a stronger move could be expected. Today, Euro area annual inflation is expected to be 9.1% in August 2022, up from 8.9% in July according to a flash estimate from Eurostat.

Looking at the main components of euro area inflation, energy is expected to have the highest annual rate in August (38.3%, compared with 39.6% in July), followed by food, alcohol & tobacco (10.6%, compared with 9.8% in July), non-energy industrial goods (5.0%, compared with 4.5% in July) and services (3.8%, compared with 3.7% in July).

Other banks including Saxo Bank and Danske Bank have said they expect a 75 basis-point hike.

Vezi cele mai recente știri & informații din piața de capital